Do Not Delay Your Financial Health: Contact Us Now for Top-Rated Counselling Providers

Why Prioritizing Your Financial Well-being Consists Of Looking For Specialist Credit Rating Coaching Solutions for Lasting Debt Relief

Attaining sustainable debt alleviation entails more than simply making repayments; it calls for a tactical strategy that deals with the origin creates of financial distress. By employing the advice of professionals in credit rating therapy, people can gain useful understandings, resources, and support to navigate their means in the direction of financial stability.

Advantages of Specialist Credit History Coaching

Engaging in professional credit score counseling can provide individuals with tailored economic strategies to effectively handle and lower their financial obligation worry. By evaluating a customer's economic scenario adequately, credit therapists can produce tailored financial obligation management intends that suit the person's particular demands and objectives.

Additionally, expert credit therapy services frequently give beneficial education and learning on financial proficiency and finance. Customers can obtain insights right into accountable costs habits, savings approaches, and lasting preparation for monetary stability. This expertise equips individuals to make enlightened decisions regarding their funds and establish healthy financial routines for the future. Additionally, credit scores therapy can provide emotional assistance and support during tough times, aiding individuals remain encouraged and devoted to their debt repayment trip. Generally, the benefits of professional debt therapy prolong past financial obligation alleviation, helping people build a solid foundation for lasting economic health.

Comprehending Financial Debt Alleviation Options

When facing frustrating debt, people must thoroughly assess and understand the various offered alternatives for financial debt alleviation. One typical debt relief choice is financial debt consolidation, where multiple financial debts are combined into a solitary funding with a reduced rates of interest. This can make it much easier to handle repayments and possibly decrease the general amount paid gradually. An additional alternative is financial obligation settlement, which includes bargaining with lenders to settle the financial obligation for much less than what is owed. While this can lead to a quicker resolution, it may also have a negative impact on credit report.

Bankruptcy can have lasting repercussions on credit history and economic future. Looking for specialist credit rating counseling solutions can aid people analyze their economic situation and figure out the most ideal financial debt relief choice based on their particular scenarios.

Creating a Personalized Financial Plan

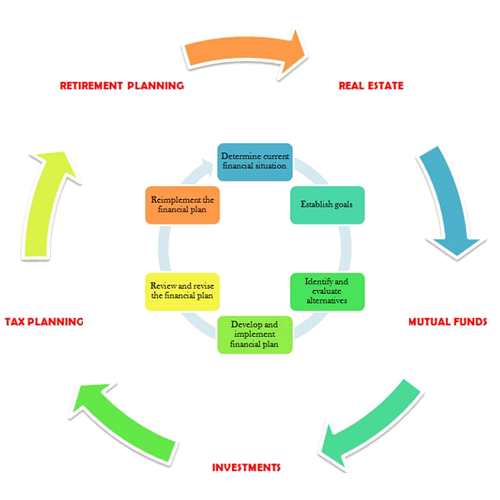

Considering the various financial debt alleviation alternatives readily available, it is important for individuals to establish a tailored monetary strategy tailored to their particular scenarios. A tailored economic plan offers as a roadmap that describes a clear path in the direction of attaining financial stability and freedom from debt.

Following, establishing specific and practical monetary goals is vital. Routinely monitoring and readjusting this budget plan as needed is necessary to remain on track towards monetary goals.

Moreover, seeking specialist credit rating therapy services can offer valuable support and assistance in creating a customized monetary plan. Credit counselors can provide skilled recommendations on budgeting, financial debt monitoring strategies, and financial planning, helping individuals make informed decisions to secure a stable financial future.

Significance of Budgeting and Saving

Efficient monetary management with budgeting and saving is fundamental to achieving long-term financial security and success. Budgeting permits people to track their revenue and expenditures, allowing them to focus on spending, identify areas for possible financial savings, and prevent unnecessary debt. By producing a budget plan that aligns with their financial goals, individuals can efficiently prepare for the future, whether it be developing a reserve, saving for retirement, or investing in properties.

Saving is similarly crucial as it offers a monetary safety and security web for unanticipated expenses and helps individuals work in the direction of their financial objectives. In look at here saving, budgeting and essence are keystone techniques that empower individuals to take control of their funds, lower financial tension, and job in the direction of achieving long-lasting economic security.

Long-Term Financial Stability

Attaining long-term monetary security is a calculated search that necessitates cautious preparation and regimented monetary administration. To protect enduring monetary wellness, individuals should focus on building a strong financial foundation that can stand up to unanticipated expenditures and economic fluctuations. This structure consists of developing an emergency fund, handling debt responsibly, and investing for the future.

One key facet of lasting look at this site economic security is developing a lasting spending plan that aligns with one's economic objectives and concerns. By tracking earnings and expenses, people can ensure that they are living within their means and saving for future needs. In addition, conserving for retirement is critical in maintaining economic security over the long term. Planning for retirement very early and constantly adding to retired life accounts can help people secure their monetary future.

Conclusion

In verdict, looking for professional credit score counselling solutions is crucial for attaining lasting financial debt relief and long-term economic security. By recognizing debt relief alternatives, creating a personalized financial strategy, and prioritizing budgeting and conserving, people can efficiently handle their funds and work towards a safe and secure monetary future. With the support of credit report counsellors, people can make educated decisions and take aggressive steps in the direction of enhancing their financial wellness.

An individualized financial strategy serves as a roadmap that lays out a clear course in the direction of accomplishing monetary stability and flexibility from financial obligation. In conserving, significance and budgeting are foundation techniques that encourage individuals to take control of their finances, minimize economic stress and anxiety, and work towards attaining lasting financial protection.

To secure long lasting monetary health, people must focus on developing a solid economic foundation that can stand up to economic fluctuations and unforeseen costs - contact us now. By leveraging expert advice, people can browse financial difficulties more successfully and function in the direction of a sustainable financial obligation alleviation plan that supports their long-term monetary wellness